Some think Mark Cuban is a genius, some think he’s lucky. Either way, the guy has a knack for seeing value where others may not, for locating long-term investments, and for ending up on the right side of the deal. Some may disagree with his approach, but Mark Cuban is a billionaire, and while making money is a lot easier when you have stacks of it to play with, becoming a billionaire doesn’t happen by accident. (Lotto winners not included.)

For those on the younger side who haven’t yet made their first billion, the investor’s early story should be comforting: After graduating from college, Cuban started his career (auspiciously enough) as a bartender. Next, he worked for a year as a salesman at a PC software retailer, making $18K in salary,before being fired for meeting with a new client to close a deal instead of opening the retail store.

He later founded MicroSolutions, a systems integrator and software reseller, but it wasn’t until eight years after grabbing his diploma that he sold his first business, which CompuServe acquired for $6 million in 1990. And then, a bit more famously, he founded a company based on his mutual love of college basketball and webcasting (Audionet), turned it into Broadcast.com, and sold it to Yahoo at the height of the dotcom boom for $5.9 billion in stock.

Since then, he’s been involved in a number of projects, most notably helping build the Dallas Mavericks, a team in which he bought a majority stake back in 2000, into an annual playoff contender and Lebron-slaying NBA Champions in 2011.

He’s also become an increasingly active angel investor in tech startups over the last decade, (you can get a brief sense of the companies he’s invested in on his CrunchBase profile), and spends quite a bit of his time coaching young entrepreneurs.

So, seeing as he’s spent more than a few minutes growing businesses, investing in startups, and advising companies on how to grow, when to pivot, and how to make money (he even recently wrote a book on the subject), we took the opportunity to ask the investor a few questions on some topical issues facing the tech industry. Check out his responses below:

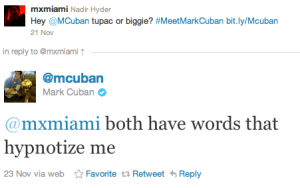

Part of the reason that the investor and Mavs owner has been in a question-answering mood lately is that one of the startups to which he plays both investor and advisor — JungleCents — recently launched a giveaway where the winner receives a free lunch with Cuban. Once users sign up for JungleCents’ newsletter, they can then tweet at the investor, asking him questions on whatever topics they choose, to which Cuban has been responding in kind.

The Mavs owner is a good guy, but obviously JungleCents’ model is one that Cuban sees great value in — enough so that he’s allowed the startup to leverage his own personal brand for promotional purposes. Of course, this is in his best interest, but how many investors agree to do that?

Cuban invested $1.5 million in JungleCents back October of last year and is joined by a board that includes Hollywood producer Peter Safran, Guy Kawasaki and Bill Reichert from Garage Ventures. The reason Cuban believes in this San Francisco-based startup? Aside from the fact that in less than a year the startup’s deals are reaching 2.2 million email addresses, publishers included, and the user sign-up rate has tripled over the last 3 months, the company is taking an alternative approach to dailydeals.

JungleCents uses a lead generation model — similar to how airlines and travel companies like Orbitz pay sites like Kayak for bringing them new customers — to give publishers supplemental revenue streams.

To do this, JungleCents accepts gift cards from companies instead of cash, then runs those as daily deals, which it offers as discounts. (You can read our initial coverage of the startup here.) In itsrecent partnership with men’s lifestyle magazine, AskMen, for example, the startup partnered with men’s merchandiser Bonobos to offer discounts on their products, which it then displayed both on JungleCents.com and AskMen.com.

This allows readers of AskMen to take advantage of a deal that’s pertinent to the content of the magazine, without having to leave the site. Customers might pay $48 for a $100 voucher to spend at Bonobos, which users can cash in whenever they want — all at once, or over time.

When I asked the owner what it was specifically that attracted him to JungleCents, he said: “I like the idea of white label deal solutions that allow sites to leverage their own traffic. The core competency of most websites is rarely if ever going to be to source deals. Junglecents can do it for them and take a share of the profits. It’s low overhead, lots of sweat equity so not a big cash investment, but with high leverage if they can match the right deals to highly trafficked sites”.

There you have it. Fire away with your questions.

Source:http://techcrunch.com/2011/11/30/startups-investing-and-daily-deals-five-questions-with-mark-cuban/

For those on the younger side who haven’t yet made their first billion, the investor’s early story should be comforting: After graduating from college, Cuban started his career (auspiciously enough) as a bartender. Next, he worked for a year as a salesman at a PC software retailer, making $18K in salary,before being fired for meeting with a new client to close a deal instead of opening the retail store.

He later founded MicroSolutions, a systems integrator and software reseller, but it wasn’t until eight years after grabbing his diploma that he sold his first business, which CompuServe acquired for $6 million in 1990. And then, a bit more famously, he founded a company based on his mutual love of college basketball and webcasting (Audionet), turned it into Broadcast.com, and sold it to Yahoo at the height of the dotcom boom for $5.9 billion in stock.

Since then, he’s been involved in a number of projects, most notably helping build the Dallas Mavericks, a team in which he bought a majority stake back in 2000, into an annual playoff contender and Lebron-slaying NBA Champions in 2011.

He’s also become an increasingly active angel investor in tech startups over the last decade, (you can get a brief sense of the companies he’s invested in on his CrunchBase profile), and spends quite a bit of his time coaching young entrepreneurs.

So, seeing as he’s spent more than a few minutes growing businesses, investing in startups, and advising companies on how to grow, when to pivot, and how to make money (he even recently wrote a book on the subject), we took the opportunity to ask the investor a few questions on some topical issues facing the tech industry. Check out his responses below:

There’s a big debate going on about whether startups are overvalued / overfunded … is there really a series A crunch and do you think this will end badly?And, what’s more, as a bonus for readers, Cuban has also agreed to answer three “top” questions posted in the comment section of this post. The three that receive the most “likes” will be chosen, so ask your own questions and “like” away. Also, a word of warning: He won’t answer basketball related questions, so keep your inquiries focused on tech and business.

It really depends on where you live. The approach to startups is far different in Silicon Valley than it is in the rest of the world. Valley startups start big. Everywhere else we take the lean, mean startup machine approach.

The former could run into cyclical financing problems because their success is dependent on exits first and operational profitability second. If the IPO market shuts again, and foreign investment dries up, the capital for Valley startups could be impacted.

As far as overfunding, it seems to me that the prevailing wisdom out West is that the only way to exit big is to start big. With that mindset there is no such thing as overfunding. But its not an approach I ever take. I’m funding multiple companies across the country every quarter. Trust me, none are overfunded. If they execute, they will get the cash they need.

Do you think Groupon is overvalued?

I like Groupon. Their valuation is whatever the market says it is. They can’t pay attention to that noise. They have to be relentless and focused on continuously adding value to their customers at the consumer and retail sides. If they can do it, they will laugh all the way to the bank.

We’ve seen the rise of Pandora and a host of interesting web radio/music services, like Spotify, take off recently. Curious how you view these players both as an investor/advisor. Do you see potential for Amazon/Google Music/Spotify etc to supplant iTunes?

It all comes down to licensing fees from the labels, both direct and statutory. One of my biggest professional mistakes at Broadcast.com was not fighting the DMCA harder. There are so many ridiculous and arbitrary limits that every music company has this as an overhang on their business.

I also worry about patent trolls coming in and killing this business.

As a guy who understands digital video better than most, what are some of the most interesting companies and trends there that you think we should be paying attention to?

Just remember one thing: The future of TV is TV. Television is still the best alternative to boredom. If you look at all the internet video companies that try to complement TV, they are doing well. If you look at those trying to replace TV, they are sucking wind. I categorize Netflix as doing well and a complement. They made a big mistake, but they are still the big dog.

Do you think Facebook has a chance to become the OS of the Internet? Or is social/friendsourcing really just in a bubble of its own?

Right now they are the platform that counts. So yes they have a chance to be the end all, be all going forward. They have become the home page for many of us. That said, their mobile solutions as a platform suck. They are very vulnerable to someone coming along and making social built on mobile a far better and more engaging experience than Facebook currently is.

Part of the reason that the investor and Mavs owner has been in a question-answering mood lately is that one of the startups to which he plays both investor and advisor — JungleCents — recently launched a giveaway where the winner receives a free lunch with Cuban. Once users sign up for JungleCents’ newsletter, they can then tweet at the investor, asking him questions on whatever topics they choose, to which Cuban has been responding in kind.

The Mavs owner is a good guy, but obviously JungleCents’ model is one that Cuban sees great value in — enough so that he’s allowed the startup to leverage his own personal brand for promotional purposes. Of course, this is in his best interest, but how many investors agree to do that?

Cuban invested $1.5 million in JungleCents back October of last year and is joined by a board that includes Hollywood producer Peter Safran, Guy Kawasaki and Bill Reichert from Garage Ventures. The reason Cuban believes in this San Francisco-based startup? Aside from the fact that in less than a year the startup’s deals are reaching 2.2 million email addresses, publishers included, and the user sign-up rate has tripled over the last 3 months, the company is taking an alternative approach to dailydeals.

JungleCents uses a lead generation model — similar to how airlines and travel companies like Orbitz pay sites like Kayak for bringing them new customers — to give publishers supplemental revenue streams.

To do this, JungleCents accepts gift cards from companies instead of cash, then runs those as daily deals, which it offers as discounts. (You can read our initial coverage of the startup here.) In itsrecent partnership with men’s lifestyle magazine, AskMen, for example, the startup partnered with men’s merchandiser Bonobos to offer discounts on their products, which it then displayed both on JungleCents.com and AskMen.com.

This allows readers of AskMen to take advantage of a deal that’s pertinent to the content of the magazine, without having to leave the site. Customers might pay $48 for a $100 voucher to spend at Bonobos, which users can cash in whenever they want — all at once, or over time.

When I asked the owner what it was specifically that attracted him to JungleCents, he said: “I like the idea of white label deal solutions that allow sites to leverage their own traffic. The core competency of most websites is rarely if ever going to be to source deals. Junglecents can do it for them and take a share of the profits. It’s low overhead, lots of sweat equity so not a big cash investment, but with high leverage if they can match the right deals to highly trafficked sites”.

There you have it. Fire away with your questions.

Source:http://techcrunch.com/2011/11/30/startups-investing-and-daily-deals-five-questions-with-mark-cuban/

No comments:

Post a Comment