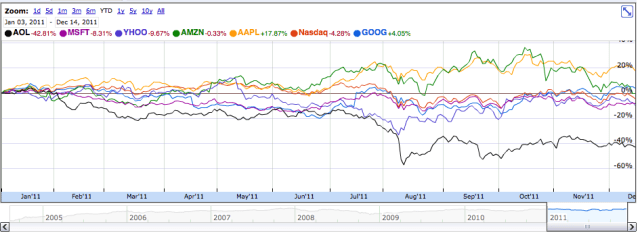

We’ve been having our fun with the things Google has been saying lately, but it’s worth looking at how people with money on the table are feeling about the company. Which is, pretty goodcompared to most other tech rivals, including Apple in the post-Steve Jobs era.

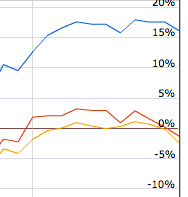

Google stock is up 16.16% in the past three months. The only other company that’s had a net positive over the same period is, er, Yahoo.

What’s making Google go up? Maybe it’s Larry Page’s aggressive new strategy to cut weaker products and focus on big new areas like mobile and social. Maybe it’s because the company has been beating earnings since he came in? Maybe it’s specifically Android’s growth (however fast that may be). Maybe it’s the not-failed user numbers coming in for Google+? Maybe it’s just the overall steady growth of its core advertising business? Or maybe traders have figured out some other information that’s not publicly available.

Obviously this is a small snapshot. If you zoom out to year to date, for example, Apple is the big winner. It’s up 17.87% versus Google’s 4.05%. And really, the big question here is why Apple’s stock is trading s0 low. That’s the question everyone keeps asking themselves. The stock price suggests that investors think there’ll be negative cash flow growth, which as Eric Savitz sketches out the other day, is basically impossible given the growth of all of its businesses.

Disclosure: As a daily user of Apple hardware and Google software (but not the other way around) I have no particular loyalty or disloyalty to either company, or any other company for that matter.

Source:http://techcrunch.com/2011/12/14/googlestock/

Google stock is up 16.16% in the past three months. The only other company that’s had a net positive over the same period is, er, Yahoo.

What’s making Google go up? Maybe it’s Larry Page’s aggressive new strategy to cut weaker products and focus on big new areas like mobile and social. Maybe it’s because the company has been beating earnings since he came in? Maybe it’s specifically Android’s growth (however fast that may be). Maybe it’s the not-failed user numbers coming in for Google+? Maybe it’s just the overall steady growth of its core advertising business? Or maybe traders have figured out some other information that’s not publicly available.

Obviously this is a small snapshot. If you zoom out to year to date, for example, Apple is the big winner. It’s up 17.87% versus Google’s 4.05%. And really, the big question here is why Apple’s stock is trading s0 low. That’s the question everyone keeps asking themselves. The stock price suggests that investors think there’ll be negative cash flow growth, which as Eric Savitz sketches out the other day, is basically impossible given the growth of all of its businesses.

Disclosure: As a daily user of Apple hardware and Google software (but not the other way around) I have no particular loyalty or disloyalty to either company, or any other company for that matter.

Source:http://techcrunch.com/2011/12/14/googlestock/

No comments:

Post a Comment