Quick, what’s the second most traded commodity in the world, after oil? Sorry, no: it’s not coffee. In fact, while hard data is scant, it may well be — of all things — carbon. No, really. According to theWorld Bank (PDF) , the global carbon market was worth a whopping 1.42 Facebooks US$142 billion in 2010.

Mind you, it’s not like container ships weighed down to the gills with graphite are crossing and recrossing the Pacific every week. What we’re actually talking about here is the trade in carbonoffsets, ie, the absence of carbon. Very Zen, no? Techies should be comfortable with this notion; I seem to recall spending less time studying electrons than I did “holes,” ie their absence, while acquiring my EE degree…

Anyway, where there’s a $twelve-figures market, there are startups fighting for a share. In particular, there’s a battle on to see who will be the primary aggregator of carbon-market data. On one side, dominating the market, I give you the Goliaths Point Carbon, a tentacle of the Thomson Reuters kraken, providing “independent news, analysis and consulting services for European and global power, gas and carbon markets,” and Bloomberg New Energy Finance, doing much the same. On the other, I give you plucky little David eCO2Market, a Paris-based startup with an algorithmic sling.

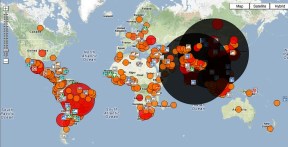

Point Carbon and BNEF crank out tomes and tomes of research analysis and offer subscription-based information tools. eCO2Market dispenses with weighty reports, and disintermediates analysts and researchers. Instead it tries to build up the biggest, most thorough, and most up-to-date database of carbon-market information, and then gives its users algorithmic tools to search, slice, dice, and organize that data themselves. The more users pay, the better the tools. (They have a free tier, too, if you’re a data geek who wants to play with what they’ve got.)

“It’s our job to take this incredibly convoluted carbon area and put it into a nice little package for investors, environmentalists, everyone, and make it as easy as possible to find projects and their participants, buy credits, or make an investment,” says Chris Draper of eCO2Market. For instance, solar-power company ToughStuff uses eCO2Market’s data to find early-stage solar projects who might be ideal ToughStuff customers.

It’s anyone’s guess whether they’ll thrive. The carbon market is in something of a fraught state right now: aside from the embarrassing theft of millions of dollars worth of carbon credits by hackers a year ago, what the World Bank delicately refers to as “regulatory uncertainty” — ie the stalled attempts to cement a successor to the Kyoto Protocol — means that the near-term future is at best uncertain.

On the other hand, this year should see the launch of the Western Climate Initiative, a cap-and-trade system involving California, Manitoba, Ontario and Quebec; and in the long run, though, cap-and-trade carbon markets are probably a growth bet. Either way, eCO2Market is an interesting example of a small startup disrupting an information market by replacing human-written research and analysis with big-data aggregation, algorithms, and visualization. The optimal solution probably features both…but it says here the scale will tip further towards the latter with every passing year.

Source:http://techcrunch.com/2012/02/04/algorithmsdata-vs-analystsreports-fight/

Mind you, it’s not like container ships weighed down to the gills with graphite are crossing and recrossing the Pacific every week. What we’re actually talking about here is the trade in carbonoffsets, ie, the absence of carbon. Very Zen, no? Techies should be comfortable with this notion; I seem to recall spending less time studying electrons than I did “holes,” ie their absence, while acquiring my EE degree…

Anyway, where there’s a $twelve-figures market, there are startups fighting for a share. In particular, there’s a battle on to see who will be the primary aggregator of carbon-market data. On one side, dominating the market, I give you the Goliaths Point Carbon, a tentacle of the Thomson Reuters kraken, providing “independent news, analysis and consulting services for European and global power, gas and carbon markets,” and Bloomberg New Energy Finance, doing much the same. On the other, I give you plucky little David eCO2Market, a Paris-based startup with an algorithmic sling.

Point Carbon and BNEF crank out tomes and tomes of research analysis and offer subscription-based information tools. eCO2Market dispenses with weighty reports, and disintermediates analysts and researchers. Instead it tries to build up the biggest, most thorough, and most up-to-date database of carbon-market information, and then gives its users algorithmic tools to search, slice, dice, and organize that data themselves. The more users pay, the better the tools. (They have a free tier, too, if you’re a data geek who wants to play with what they’ve got.)

“It’s our job to take this incredibly convoluted carbon area and put it into a nice little package for investors, environmentalists, everyone, and make it as easy as possible to find projects and their participants, buy credits, or make an investment,” says Chris Draper of eCO2Market. For instance, solar-power company ToughStuff uses eCO2Market’s data to find early-stage solar projects who might be ideal ToughStuff customers.

It’s anyone’s guess whether they’ll thrive. The carbon market is in something of a fraught state right now: aside from the embarrassing theft of millions of dollars worth of carbon credits by hackers a year ago, what the World Bank delicately refers to as “regulatory uncertainty” — ie the stalled attempts to cement a successor to the Kyoto Protocol — means that the near-term future is at best uncertain.

On the other hand, this year should see the launch of the Western Climate Initiative, a cap-and-trade system involving California, Manitoba, Ontario and Quebec; and in the long run, though, cap-and-trade carbon markets are probably a growth bet. Either way, eCO2Market is an interesting example of a small startup disrupting an information market by replacing human-written research and analysis with big-data aggregation, algorithms, and visualization. The optimal solution probably features both…but it says here the scale will tip further towards the latter with every passing year.

Source:http://techcrunch.com/2012/02/04/algorithmsdata-vs-analystsreports-fight/

No comments:

Post a Comment