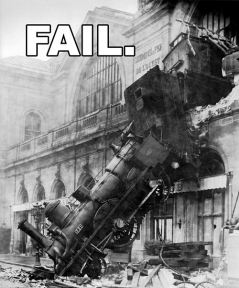

Pharmaceutical companies are in trouble with ongoingpatent cliffs with a clear choice facing them. They can follow the path of the railroad industry which is the path most are on right now. Alternatively, they can follow the path IBM took when its future was similarly bleak. IBM demonstrated how it’s possible for a large company to shift from a product-centric culture to a customer and service centered company. It’s clear that pharma companies will succeed or fail based not on how many drugs they sell, but on how well their offerings improve health outcomes.

The marketing myopia of the railroad industry is well documented in the world of business yet industry after industry makes the same mistake. Railroad companies thought they were in the “railroad” business, rather than the “transportation” business. As a consequence, they missed out on countless opportunities to pursue growth in the auto industry. In contrast, IBM was able to use their existential threat to reinvent themselves over a critical 10 year period. The result: A 10x increase in their stock value. In contrast, most pharmaceutical companies aren’t spending enough time thinking like IBM. Looking at the 10-year stock charts of these organizations you see flat or declining stock prices. This is a clear indication that they haven’t reinvented themselves.

Pfizer 10 year stock chart

The Key Question Pharma Must Answer

Pfizer 10 year stock chart

The Key Question Pharma Must Answer

Does the pharmaceutical company see themselves in the drug business or the disease management business? Or, where possible, in the disease prevention business? This is the critical questions to survive and thrive. Many of these diseases lend themselves to the use applications (mobile & web) or biometric devices. This is going to drive a greatly expanded focus on non-traditional partnerships.

An example of how a pharmaceutical company could transition from being product centric to being customer centric is doing something like the company, Ambucor. Ambucor provides Ambulatory Electrocardiographic and Remote Device Monitoring services for cardiologists. Pharma companies already have deep relationships with cardiologists. Imagine them buying or partnering with a company like Ambucor to sell that service. This would provide a more complete offering where their heart-related drugs may or may not play a role, just as IBM products may or may not play a role in their services.

Lessons from IBM

Most pharma companies are where computer makers were in the late 80′s: the handwriting on the wall is clear but pharma is still mainly focused on milking the cash cows just as DEC, Data General, Wang were in the 80′s. It was only when IBM brought in Lou Gerstner having recognized the threat, were they able to drive wrenching changes. During his 10 years, the stock price of this mature company grew nearly 10x — a stark contrast to the stock price of most pharma companies over the last 10 years.

While IBM’s transition looks brilliant, and without pain in hindsight, that was far from the case. At the time it was extremely controversial. Most business magazines characterized IBM as a dinosaur. At the same time, conventional wisdom was that Gerstner needed to break up IBM to drive shareholder value, not a massive transformation. Turning over half of their workforce created additional heat for Gerstner. However, at the end of it, IBM came away much stronger in contrast to their competitors such as DEC.

Once pharma companies redefine themselves in the disease management/prevention business, they will recognize that they are far behind the market leaders. While they wait for the future to be defined by others, non-traditional competitors are taking action. Just look at Aetna. They have aggressively bought an array of companies including mobile startups such as iTriage. Pharma may wake up and realize they are late to the party and the most interesting companies already have found their dance partner.

Leveraging Pharma Strengths to Provide a Complete Solution

Just as IBM has a number of strengths it could leverage into its reinvention process, Pharma also has strengths such as:

The list below contains examples of technology-enabled services pharma can provide if they were to focus on disease management or prevention. One of the non-obvious benefits of operating a multi-tenant SaaS business is the insights that can be gleaned through the broad dataset from many customers hosted in one place. For example, ZocDoc will have supply and demand insights no one else has for healthcare services by helping consumers find open appointment slots. It’s not hard to imagine the insights that could be learned from the examples below.

There are people reading this who know far more about the Pharma industry than me. I’ve been asked enough times how pharma should reinvent itself that I gave it some thought. The only thing I know for sure is continuing the path that most pharma is on will lead to a continued flat business (and stock price). Where have I missed the boat? What opportunities for reinvention have I missed?

Source:http://techcrunch.com/2012/02/26/what-pharma-can-learn-from-the-railroads-and-ibm/

The marketing myopia of the railroad industry is well documented in the world of business yet industry after industry makes the same mistake. Railroad companies thought they were in the “railroad” business, rather than the “transportation” business. As a consequence, they missed out on countless opportunities to pursue growth in the auto industry. In contrast, IBM was able to use their existential threat to reinvent themselves over a critical 10 year period. The result: A 10x increase in their stock value. In contrast, most pharmaceutical companies aren’t spending enough time thinking like IBM. Looking at the 10-year stock charts of these organizations you see flat or declining stock prices. This is a clear indication that they haven’t reinvented themselves.

Pfizer 10 year stock chart

Pfizer 10 year stock chartDoes the pharmaceutical company see themselves in the drug business or the disease management business? Or, where possible, in the disease prevention business? This is the critical questions to survive and thrive. Many of these diseases lend themselves to the use applications (mobile & web) or biometric devices. This is going to drive a greatly expanded focus on non-traditional partnerships.

An example of how a pharmaceutical company could transition from being product centric to being customer centric is doing something like the company, Ambucor. Ambucor provides Ambulatory Electrocardiographic and Remote Device Monitoring services for cardiologists. Pharma companies already have deep relationships with cardiologists. Imagine them buying or partnering with a company like Ambucor to sell that service. This would provide a more complete offering where their heart-related drugs may or may not play a role, just as IBM products may or may not play a role in their services.

Lessons from IBM

Most pharma companies are where computer makers were in the late 80′s: the handwriting on the wall is clear but pharma is still mainly focused on milking the cash cows just as DEC, Data General, Wang were in the 80′s. It was only when IBM brought in Lou Gerstner having recognized the threat, were they able to drive wrenching changes. During his 10 years, the stock price of this mature company grew nearly 10x — a stark contrast to the stock price of most pharma companies over the last 10 years.

While IBM’s transition looks brilliant, and without pain in hindsight, that was far from the case. At the time it was extremely controversial. Most business magazines characterized IBM as a dinosaur. At the same time, conventional wisdom was that Gerstner needed to break up IBM to drive shareholder value, not a massive transformation. Turning over half of their workforce created additional heat for Gerstner. However, at the end of it, IBM came away much stronger in contrast to their competitors such as DEC.

Once pharma companies redefine themselves in the disease management/prevention business, they will recognize that they are far behind the market leaders. While they wait for the future to be defined by others, non-traditional competitors are taking action. Just look at Aetna. They have aggressively bought an array of companies including mobile startups such as iTriage. Pharma may wake up and realize they are late to the party and the most interesting companies already have found their dance partner.

Leveraging Pharma Strengths to Provide a Complete Solution

Just as IBM has a number of strengths it could leverage into its reinvention process, Pharma also has strengths such as:

- Provider Relationships: Through its Medical Affairs and Sales organizations, Pharma has many relationships and a keen understanding of the healthcare landscape (though provider access has waned). They know proper ways to work with healthcare professionals for research as well as the reimbursement environment for particular conditions.

- Clinical Trials Management: Pharma has a critical competence in managing clinical trials with an array of patients and the necessary requirements to have research findings that can pass muster with the FDA and/or health plans.

- Information Technology Management: The IT departments of many pharma companies are sophisticated given the importance of security, research database management and the like.

- Long-term view: Pharma hasn’t been afraid to make long-term bets utilizing its deep pockets. Fortunately, most technology bets require dramatically less resource than what they are used to.

The list below contains examples of technology-enabled services pharma can provide if they were to focus on disease management or prevention. One of the non-obvious benefits of operating a multi-tenant SaaS business is the insights that can be gleaned through the broad dataset from many customers hosted in one place. For example, ZocDoc will have supply and demand insights no one else has for healthcare services by helping consumers find open appointment slots. It’s not hard to imagine the insights that could be learned from the examples below.

- Population Management: Patient-centered Medical Homes and Accountable Care Organizations place demands on providers that many are ill-prepared to address. Keeping track of the portion of their patient population that is up-to-date on vaccines, health checks, etc. and scheduling them for appropriate services is a big challenge. Already pharma pay doctors a significant amount of money to get patients to complete registries. Massively expanding this can not only provide a service to providers but also provide necessary data input for pharma’s research needs.

- Family Medical History: Related to the previous item, Medicare announced its first wellness oriented reimbursement for an annual wellness visit. Relatively few healthcare providers have taken advantage of this. Not only could pharma help them with this proactive new revenue stream, the insights that could be gained would be phenomenal for pharma.

- Rx for apps: Before long, rather than being prescribed a pill, people will be prescribed apps that have established an evidence-base that proves they are effective. Vendors such asHapptique will provide what amounts to an “app formulary” for providers. Not only enabling the prescription of an app but the accompanying app adherence could be a valuable service.

- Remote monitoring: Ambucor is one example. There is a wide range of remote monitoring devices. These span devices, disease and health management. While it can be used for serious diseases, it’s not hard to imagine that health coaches could provide a service to manage wellness programs as personal biometric devices become more pervasive.

- Telehealth: Related to the previous example, more and more services can be provided remotely. Providing the tools and services to manage conditions remotely that aren’t device related is very possible. One of the first areas this is being done in is behavioral health. It will expand.

There are people reading this who know far more about the Pharma industry than me. I’ve been asked enough times how pharma should reinvent itself that I gave it some thought. The only thing I know for sure is continuing the path that most pharma is on will lead to a continued flat business (and stock price). Where have I missed the boat? What opportunities for reinvention have I missed?

Source:http://techcrunch.com/2012/02/26/what-pharma-can-learn-from-the-railroads-and-ibm/

No comments:

Post a Comment