If you look closely at Netflix’s fourth quarter earnings, it will become clear why the company wanted to split its DVD and streaming businesses. This is the first quarter that the company is splitting out each business and reporting revenues, profits, and margins separately.

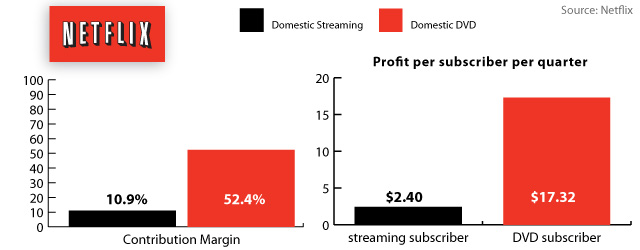

While the streaming business is growing (adding 220 subscribers domestically in the quarter), and the DVD business sis shrinking (it lost 2.76 million subscribers domestically), it’s margins are much worse than the legacy DVD business. The streaming business has an 11 percent profit margin, compared to a very healthy 52 percent margin for the DVD business.

Out of Netflix’s total $847 million in revenues last quarter, $476 million came from streaming and $370 million came from DVD rentals (the remainder came from international). The streaming business also twice as many subscribers: 21.7 million versus 11.2 million. But the DVD business contributed the vast majority of Netflix’s profit: $194 million versus $52 million.

If you break that down, each streaming subscriber is worth only $2.40 in profit each quarter to Netflix, compared to $17.32 for each DVD subscriber. The old business was very lucrative. The new business kind of sucks. The economics are very different. The DVD business had fixed costs, while Netflix is forced to negotiate streaming licenses on a case by case basis with each media company.

Investors are going to have to figure out how long the old DVD business can keep generating cash until the new streaming business takes off, but the stock will be valued based on those future cash flows from streaming. And those future cash flows are worth a lot less than the cash flows from the DVD business. At least that is what it looks like right now.

Netflix says in its shareholder letter that it expects to be able to increase its streaming margin by one percent a quarter. But how long can it do that before it reaches a natural ceiling? 15 percent? 20 percent? more? That is the big unknown with Netflix. The streaming business is not likely to ever be a 50 percent margin business. But where it will eventually settle will be one of the major factors which determine Netflix’s ultimate value.

During the conference call, CEO Reed Hastings suggested that as Netflix gets better content through licensing deals and original programming, its margin should rise. But it is not quite there yet. “We feel great about the content we’ve got,” he says. “We don’t feel great about the profit stream.”

While the streaming business is growing (adding 220 subscribers domestically in the quarter), and the DVD business sis shrinking (it lost 2.76 million subscribers domestically), it’s margins are much worse than the legacy DVD business. The streaming business has an 11 percent profit margin, compared to a very healthy 52 percent margin for the DVD business.

Out of Netflix’s total $847 million in revenues last quarter, $476 million came from streaming and $370 million came from DVD rentals (the remainder came from international). The streaming business also twice as many subscribers: 21.7 million versus 11.2 million. But the DVD business contributed the vast majority of Netflix’s profit: $194 million versus $52 million.

If you break that down, each streaming subscriber is worth only $2.40 in profit each quarter to Netflix, compared to $17.32 for each DVD subscriber. The old business was very lucrative. The new business kind of sucks. The economics are very different. The DVD business had fixed costs, while Netflix is forced to negotiate streaming licenses on a case by case basis with each media company.

Investors are going to have to figure out how long the old DVD business can keep generating cash until the new streaming business takes off, but the stock will be valued based on those future cash flows from streaming. And those future cash flows are worth a lot less than the cash flows from the DVD business. At least that is what it looks like right now.

Netflix says in its shareholder letter that it expects to be able to increase its streaming margin by one percent a quarter. But how long can it do that before it reaches a natural ceiling? 15 percent? 20 percent? more? That is the big unknown with Netflix. The streaming business is not likely to ever be a 50 percent margin business. But where it will eventually settle will be one of the major factors which determine Netflix’s ultimate value.

During the conference call, CEO Reed Hastings suggested that as Netflix gets better content through licensing deals and original programming, its margin should rise. But it is not quite there yet. “We feel great about the content we’ve got,” he says. “We don’t feel great about the profit stream.”

No comments:

Post a Comment