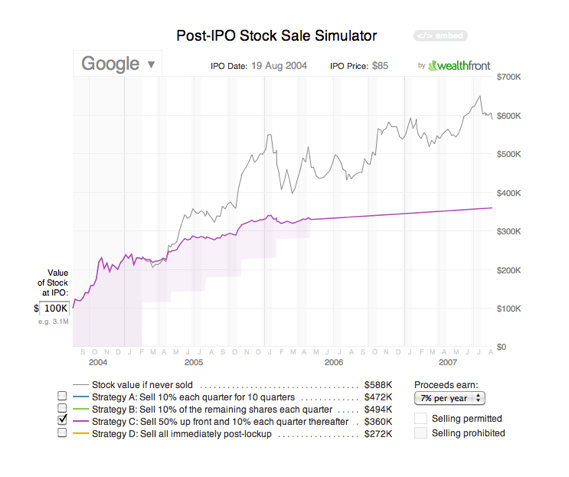

One of the challenges that many post-IPO tech company employees will face is when to sell stock and how much stock to sell once the their stock lockups conclude.Financial advisors can help with this, but some aren’t experienced enough with the specific fluctuations of tech companies to create a financially wise strategy. Wealthfront (formerly kaChing), a startup that has been disrupting the investing and personal finance space, is debuting a new tool employees use to test option sale strategies post IPO. Basically, Wealthfront will allow you to test various strategies against the actual stock behavior of a number of tech companies that went public in the past 10 years. The tool is actually embedded below so you can test it out.

As we’ve written in the past, Wealthfront brings the quality investment theories of a fund manager online, at a much lower fee, essentially democratizing private wealth management to the masses. The startup is the brainchild of Andy Rachleff, who was formerly a founder of Benchmark Capital.

Rachleff explains that the current tool looks at five typical stock performance patterns: increasing (Google, Salesforce), decreasing (DivX), peak-dominated (Netflix), u-shaped (VMWare) and oscillating (Orbitz). To showcase the tool’s technology, Wealthfront picked 10 companies, two that fit each pattern, to offer real-life examples. Basically, you compare your company’s stock performance to one of these companies.

The tool then applies four different stock-sale strategies to the stock performance of each company, comparing the results to what would have happened if an employee sold no shares. For example, one sample plan shows an employee selling 10% each quarter for 10 quarters. Or an employee could sell 50% up front and 10% per quarter for five quarters. And there’s always the option of selling all shares vested immediately post-lockup.

So, Wealthfront can determine if your company’s stock performance is going to be similar to that of Google, then you are better off holding more stock. If you work for a company that’s going to perform like DivX, you’ll be better off unloading all of your stock on day one, after the lockup period expires. Generally, Wealthfront advises employees to sell shares gradually.

Wealthfront says it will update the simulator to include more companies and sales strategies in the future. The tool could definitely be useful for the growing number of Silicon Valley tech employees that are finding themselves as shareholders of stock from companies that recently went public.

Wealthfront has raised over $10 million from DAG Ventures and individual investors including Marc Andreessen, Jeff Jordan and partners from Benchmark Capital, Index Ventures and Kleiner Perkins Caufield & Byers.

Source:http://techcrunch.com/2012/02/06/wealthfront-allows-tech-company-stock-holders-to-test-share-sale-strategies-post-ipo/

As we’ve written in the past, Wealthfront brings the quality investment theories of a fund manager online, at a much lower fee, essentially democratizing private wealth management to the masses. The startup is the brainchild of Andy Rachleff, who was formerly a founder of Benchmark Capital.

Rachleff explains that the current tool looks at five typical stock performance patterns: increasing (Google, Salesforce), decreasing (DivX), peak-dominated (Netflix), u-shaped (VMWare) and oscillating (Orbitz). To showcase the tool’s technology, Wealthfront picked 10 companies, two that fit each pattern, to offer real-life examples. Basically, you compare your company’s stock performance to one of these companies.

The tool then applies four different stock-sale strategies to the stock performance of each company, comparing the results to what would have happened if an employee sold no shares. For example, one sample plan shows an employee selling 10% each quarter for 10 quarters. Or an employee could sell 50% up front and 10% per quarter for five quarters. And there’s always the option of selling all shares vested immediately post-lockup.

So, Wealthfront can determine if your company’s stock performance is going to be similar to that of Google, then you are better off holding more stock. If you work for a company that’s going to perform like DivX, you’ll be better off unloading all of your stock on day one, after the lockup period expires. Generally, Wealthfront advises employees to sell shares gradually.

Wealthfront says it will update the simulator to include more companies and sales strategies in the future. The tool could definitely be useful for the growing number of Silicon Valley tech employees that are finding themselves as shareholders of stock from companies that recently went public.

Wealthfront has raised over $10 million from DAG Ventures and individual investors including Marc Andreessen, Jeff Jordan and partners from Benchmark Capital, Index Ventures and Kleiner Perkins Caufield & Byers.

Source:http://techcrunch.com/2012/02/06/wealthfront-allows-tech-company-stock-holders-to-test-share-sale-strategies-post-ipo/

No comments:

Post a Comment