Congratulations Facebook! You have made history and changed the world. So, here are some thoughts from one of your biggest fans. Like the rest of the planet, I love Facebook and use it every day. So, there may never be a better time than now, when things are going really well, to add a dose of humility and perspective to the Facebook conversation.

Remember the movie Gladiator? Commodus, the bad son, murdered his aging father, Emperor Marcus Aurelius, preventing him from passing the empire down to his adopted good son, Maximus. Thus, instead of carrying on a centuries old tradition of merit-based succession, power passed to an unworthy blood relative and corruption followed.

What does this have to do with Facebook founder Mark Zuckerberg? Well, according to the $5 billion IPO filing, legal documents give him absolute control over the post-IPO company, even beyond the grave, just like a Roman emperor. That kind of power can have unintended consequences.

The story of Facebook’s spectacularly successful founder serves as a blueprint for others who hope to create corporate dynasties. Still, both he and those who seek to emulate him would be wise to take the counsel of history and establish at least a minimally representative corporate governance structure that includes one or more independent board members.

How did governance get to this point?

Facebook came of age after Google’s founders obtained super majority control at IPO, followed by LinkedIn, Groupon and Zynga (and more). In its early days, Sean Parker, a serial entrepreneur (Napster, Plaxo) who played an important early role as a confidante to Mr. Zuckerberg, helped convince him of the importance of founders maintaining control. As such, the Facebook founder has long dominated his board of directors, appointing three out of five seats.

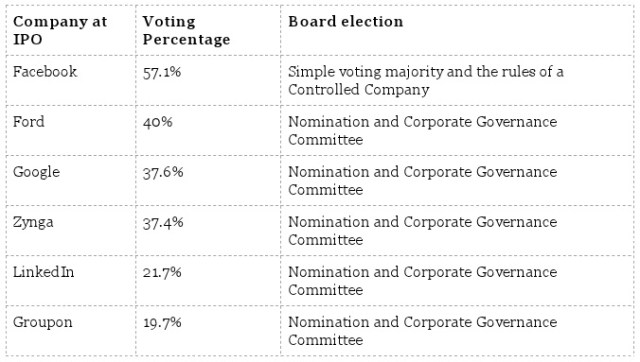

Now, Facebook takes the founder-control trend to the extreme. By converting his shares into a class of super-voting stock at IPO, and designating Facebook as a “controlled company,” Zuckerberg will not only control 57.1% of the vote, but will also have the legal right to name 100% of the board of directors. He can also designate whomever he chooses as the successor to his corporate authority.

The unintended consequence of such absolute control may be the opposite of what Zuckerberg hopes. It isn’t a stretch to believe that he genuinely wants control in order to keep the business focused on the long-term social mission he described in his letter to shareholders, rather than the short-term gains often demanded by financial managers. What may happen instead is that the post-IPO business finds itself subject to whimsical decision-making and vulnerable to the inevitable securities lawsuits.

When founder-controlled companies sell shares to the public, they should plan for the possibility of the emperor at some point “having no clothes.” Eventually, even the best founders can lose their mojo, or appoint a successor who proves unequal to the task. This is when having independent views and fiduciaries can help shield the business from liability and guide it to a better place, even without legal control.

Of course, founder-controlled companies are often extraordinarily successful. In the United States, the founding family is an influential investor in more than one-third of the Standard & Poor’s 500 companies. Founding family owned companies tend to do well because of the long-term influence, interest, and investment of owners who are motivated by mission, not just by financial gain.

For example, Ford Motor Company has managed to sustain a profitable founding family business since Henry Ford incorporated it in 1903. Since 1956, the Ford family has wielded at least 40% of the company’s voting rights by setting up a system to ensure that only family members can own Class B stock. The family’s voting power includes the exclusive right to approve a merger, sale, or liquidation of the company.

In their desire to control but not stifle the business, the Fords enlisted qualified advisers, including original counsel Clifford Longley, investor Goldman Sachs, and independent directors. And it worked; Ford has survived multiple recessions, including the most recent economic downturn. Ford was the only American carmaker that didn’t need a government bailout.

Mr. Zuckerberg has so far made a different choice about the governance of Facebook. While appointing Sheryl Sandberg as a strong #2 has been brilliant, what will he do when she moves on? He and his heirs can exercise more corporate power post-IPO than when it was private. Opting to function as a “controlled company,” Facebook will be exempt from the customary stock exchange corporate governance rules that apply to the vast majority of public companies.

From the Facebook prospectus (S-1):

majority ownership and voting rights, the triumvirate approach has balanced governance, and none of their rights extends to the power to appoint and remove independent directors at will. The same goes for Reid Hoffman at LinkedIn, Andrew Mason at Groupon and Mark Pincus at Zynga.

So, if you are a company founder, and you single-mindedly want to make your business a founder-controlled dynasty, Facebook is your blueprint. If, on the other hand, your goals include protecting the durability of the company you founded, even when you and your heirs may no longer project the visionary qualities that you do today, you should: 1) empower your company’s non-founder shareholders to elect at least 1 independent director; and 2) commit to a succession plan that is not hereditary by default.

Eva Arevuo also contributed to this article.

Source:http://techcrunch.com/2012/02/11/mark-zuckerberg-dynasty/?grcc=33333Z98

Remember the movie Gladiator? Commodus, the bad son, murdered his aging father, Emperor Marcus Aurelius, preventing him from passing the empire down to his adopted good son, Maximus. Thus, instead of carrying on a centuries old tradition of merit-based succession, power passed to an unworthy blood relative and corruption followed.

What does this have to do with Facebook founder Mark Zuckerberg? Well, according to the $5 billion IPO filing, legal documents give him absolute control over the post-IPO company, even beyond the grave, just like a Roman emperor. That kind of power can have unintended consequences.

The story of Facebook’s spectacularly successful founder serves as a blueprint for others who hope to create corporate dynasties. Still, both he and those who seek to emulate him would be wise to take the counsel of history and establish at least a minimally representative corporate governance structure that includes one or more independent board members.

How did governance get to this point?

Facebook came of age after Google’s founders obtained super majority control at IPO, followed by LinkedIn, Groupon and Zynga (and more). In its early days, Sean Parker, a serial entrepreneur (Napster, Plaxo) who played an important early role as a confidante to Mr. Zuckerberg, helped convince him of the importance of founders maintaining control. As such, the Facebook founder has long dominated his board of directors, appointing three out of five seats.

Now, Facebook takes the founder-control trend to the extreme. By converting his shares into a class of super-voting stock at IPO, and designating Facebook as a “controlled company,” Zuckerberg will not only control 57.1% of the vote, but will also have the legal right to name 100% of the board of directors. He can also designate whomever he chooses as the successor to his corporate authority.

The unintended consequence of such absolute control may be the opposite of what Zuckerberg hopes. It isn’t a stretch to believe that he genuinely wants control in order to keep the business focused on the long-term social mission he described in his letter to shareholders, rather than the short-term gains often demanded by financial managers. What may happen instead is that the post-IPO business finds itself subject to whimsical decision-making and vulnerable to the inevitable securities lawsuits.

When founder-controlled companies sell shares to the public, they should plan for the possibility of the emperor at some point “having no clothes.” Eventually, even the best founders can lose their mojo, or appoint a successor who proves unequal to the task. This is when having independent views and fiduciaries can help shield the business from liability and guide it to a better place, even without legal control.

Of course, founder-controlled companies are often extraordinarily successful. In the United States, the founding family is an influential investor in more than one-third of the Standard & Poor’s 500 companies. Founding family owned companies tend to do well because of the long-term influence, interest, and investment of owners who are motivated by mission, not just by financial gain.

For example, Ford Motor Company has managed to sustain a profitable founding family business since Henry Ford incorporated it in 1903. Since 1956, the Ford family has wielded at least 40% of the company’s voting rights by setting up a system to ensure that only family members can own Class B stock. The family’s voting power includes the exclusive right to approve a merger, sale, or liquidation of the company.

In their desire to control but not stifle the business, the Fords enlisted qualified advisers, including original counsel Clifford Longley, investor Goldman Sachs, and independent directors. And it worked; Ford has survived multiple recessions, including the most recent economic downturn. Ford was the only American carmaker that didn’t need a government bailout.

Mr. Zuckerberg has so far made a different choice about the governance of Facebook. While appointing Sheryl Sandberg as a strong #2 has been brilliant, what will he do when she moves on? He and his heirs can exercise more corporate power post-IPO than when it was private. Opting to function as a “controlled company,” Facebook will be exempt from the customary stock exchange corporate governance rules that apply to the vast majority of public companies.

From the Facebook prospectus (S-1):

Because we qualify as a “controlled company” under the corporate governance rules for publicly-listed companies, we are not required to have a majority of our board of directors be independent, nor are we required to have a compensation committee or an independent nominating function.Instead of a nominating committee for directors, all directors will be selected, removed and replaced by Mr. Zuckerberg, who is also imbued with the power to unilaterally choose a successor.

Mr. Zuckerberg has the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of our assets … Additionally, in the event that Mr. Zuckerberg controls our company at the time of his death, control may be transferred to a person or entity that he designates as his successor.While Larry Page, Sergey Brin, and Eric Schmidt at Google also maintain control, with

majority ownership and voting rights, the triumvirate approach has balanced governance, and none of their rights extends to the power to appoint and remove independent directors at will. The same goes for Reid Hoffman at LinkedIn, Andrew Mason at Groupon and Mark Pincus at Zynga.

So, if you are a company founder, and you single-mindedly want to make your business a founder-controlled dynasty, Facebook is your blueprint. If, on the other hand, your goals include protecting the durability of the company you founded, even when you and your heirs may no longer project the visionary qualities that you do today, you should: 1) empower your company’s non-founder shareholders to elect at least 1 independent director; and 2) commit to a succession plan that is not hereditary by default.

Eva Arevuo also contributed to this article.

Source:http://techcrunch.com/2012/02/11/mark-zuckerberg-dynasty/?grcc=33333Z98

No comments:

Post a Comment