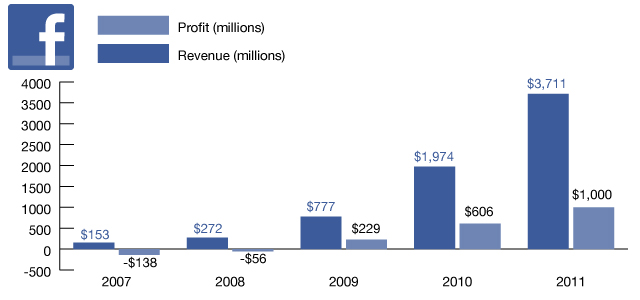

Facebook just filed its IPO registration (SEC doc here) and its financials are off the charts. Facebook’s IPO document provides the first peek at its financials.

The company did $3.7 billion in revenues in 2011, and $1 billion in profits. That’s right. Net income was $1 billion. In fact, it was exactly, $1.000 billion (I don’t think that was a coincidence). Profits grew 65 percent last year from $606 million in 2010. And revenues grew 88 percent. Revenues come primarily from advertising (85%), as well as payments for virtual goods (15%) and platform development fees (negligible). Payments alone was a $557 million business last year, a number which our own Eric Eldon nailed in December.

The company has an extremely healthy 27 percent net profit margin (its operating profit margin is 47 percent). That is right in line with Google’s net profit margins of 26 percent. Software margins are a beautiful thing.

Facebook’s business throws off a ton of cash. Net operating cash in 2011 was $1.5 billion, up 122 percent from 2010. Free cash flow (a related measure) was $470 million in 2011. The company ended the year with $3.9 billion in cash.

Here is some of our additional coverage on the filing:

Source:http://techcrunch.com/2012/02/01/facebook-1-billion-profit/The company did $3.7 billion in revenues in 2011, and $1 billion in profits. That’s right. Net income was $1 billion. In fact, it was exactly, $1.000 billion (I don’t think that was a coincidence). Profits grew 65 percent last year from $606 million in 2010. And revenues grew 88 percent. Revenues come primarily from advertising (85%), as well as payments for virtual goods (15%) and platform development fees (negligible). Payments alone was a $557 million business last year, a number which our own Eric Eldon nailed in December.

The company has an extremely healthy 27 percent net profit margin (its operating profit margin is 47 percent). That is right in line with Google’s net profit margins of 26 percent. Software margins are a beautiful thing.

Facebook’s business throws off a ton of cash. Net operating cash in 2011 was $1.5 billion, up 122 percent from 2010. Free cash flow (a related measure) was $470 million in 2011. The company ended the year with $3.9 billion in cash.

Here is some of our additional coverage on the filing:

- Facebook’s S-1 Letter From Zuckerberg Urges Understanding Before Investment

- Facebook’s S-1 Reveals: 845 Million Users Every Month, More Than Half Daily, Half Mobile

- Facebook’s S-1 And The Largest Shareholders: Who Owns What?

No comments:

Post a Comment