According to a new report from managed enterprise mobility provider Good Technology, iOS devices (iPhones and iPads) hold the top three spots in the list of the top 10 enterprise activations by device type. The report includes data gathered by Good for Q4 2011 and includes half of the Fortune 100, providing insight into enterprise activation trends among some of the world’s biggest businesses.

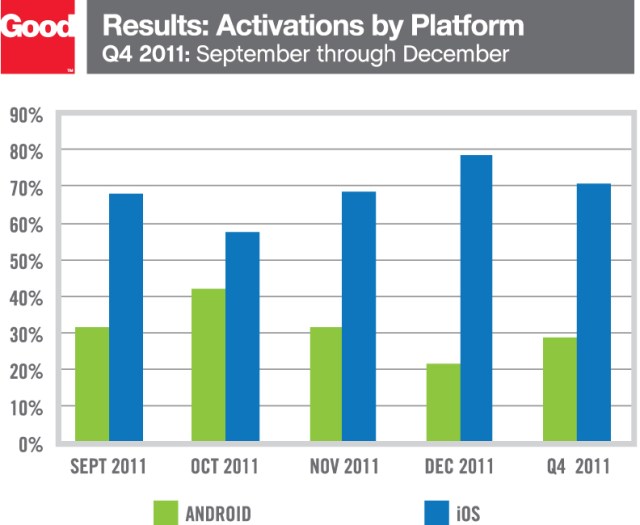

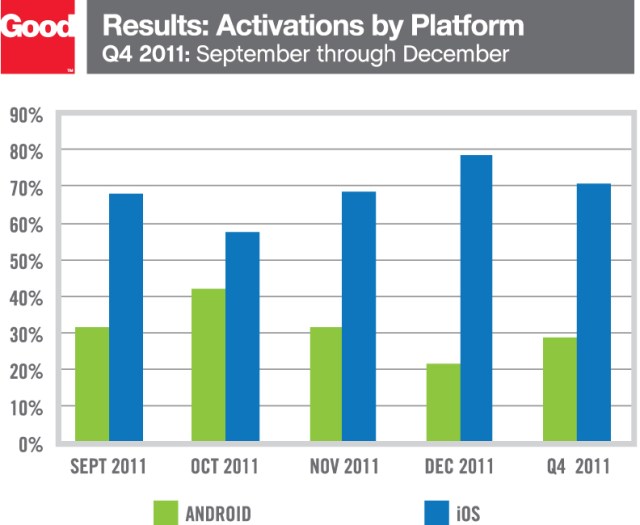

The company found that despite Android’s overall market share growth and steady absolute growth among Good’s customers, only 35% of all smartphone activations were on Android, compared with iPhone’s 65%.

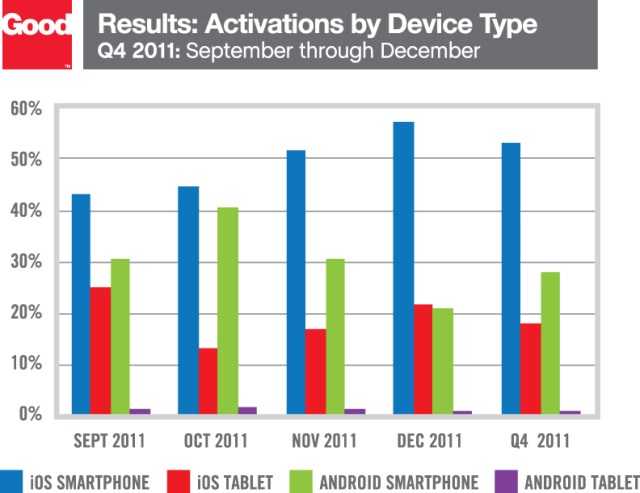

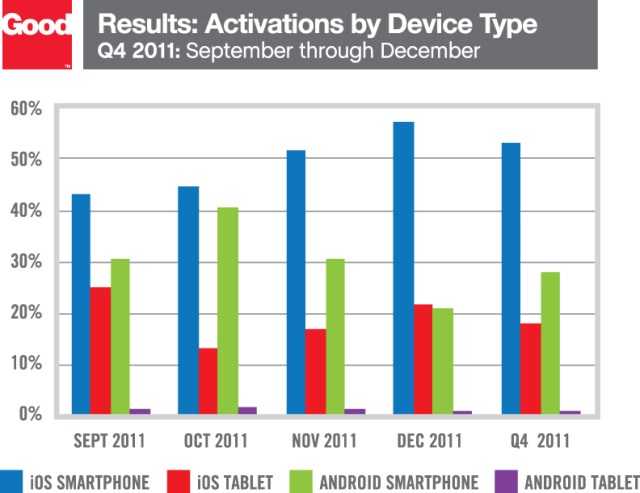

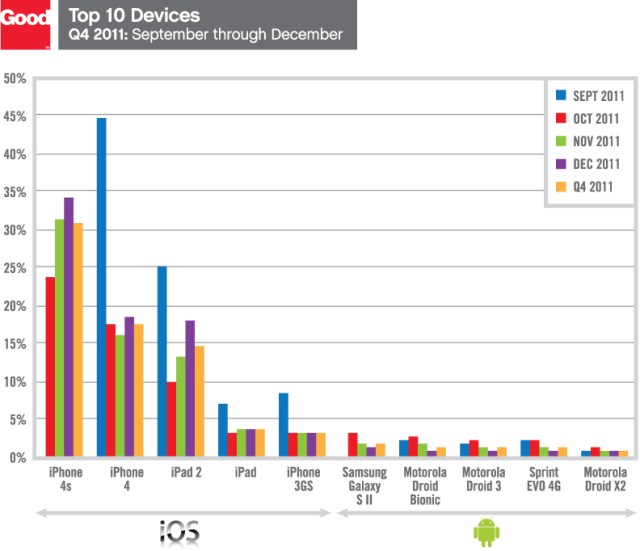

The mid-October release of the iPhone 4S helped that particular device quickly earn the number one position on the top 10 enterprise activations list, with the iPhone 4 moving into spot #2. The iPad 2, meanwhile, claimed the third position.

Since there are far more Android devices than iPhone models, it’s not as fair to compare trends on a device-by-device basis. After all, there’s aren’t just a couple models of Android phones out there – there are dozens upon dozens of “top” (popular) devices.

However, even when looked at as a whole, Android activations accounted for just 35% of the smartphone activations and only 6% of tablet activations. The Samsung Galaxy S II was the top Android device at spot #6 and was followed by the Motorola Droid Bionic, the Motorola Droid 3, Sprint EVO 4G (Q3′s most popular Android device) and the Motorola Droid X2. Motorola phones were popular over the course of the past year, too, and were represented in the top 10 each quarter.

Good does note that iPhone activations had slowed in the previous quarter, in anticipation of the new iPhone, then jumped significantly after its launch, with 31% of smartphone activations from that device alone. But collectively, iOS devices accounted for over 70% of all activations in Q4, an indication that enterprise customers’ iOS preference wasn’t just being boosted by the iPhone 4S launch. iOS is the preferred choice in the enterprise, Good says.

On the tablet front, iOS’s domination is even more apparent – the iPad and iPad 2 account for 94% of the total tablet activations in Q4, compared with 6% for Android tablets, where the Galaxy Tab leads the pack. iPads were most popular in three industries: financial services (accounting for 42% for the quarter), business/professional services and life sciences.

Going into Q1 and Q2, Good says that it expects iPad and iPad 2 activations to slow heading into March, as customers prepare for the (rumored) launch of the iPad 3. It also expects Android activations to increase on a relative basis after the immediate impact of the iPhone 4S lessens and as BYOD (bring your own device) programs become more common.

However, says John Herrema, Senior Vice President of Corporate Strategy at Good, the company expects the iOS/Android numbers to be roughly the same during the first half of 2012 as they are now. A change would require a major shift in tablet trends. “I don’t see that happening with the iPad 3 on the horizon,” says Herrema.

“If Android and iOS split smartphone [market share] or even if Android takes the overall smartphone lead, it would still likely be no more than 40% of all Good activations overall, given the dominance of Apple on tablets and the large numbers of tablets we are activating. Meanwhile, I don’t see Android dropping substantially below where it is now because that would require major shift among BYOD smartphone users.”

We should note that this report does not look at RIM devices or Windows Phone, as Good doesn’t have insight into these platforms. This is only a comparison between the iOS/Android adoption rates in the enterprise, which by itself, limits itself to enterprise environments where BlackBerry has already fallen from favor.

Source:http://techcrunch.com/2012/01/25/android-may-have-consumer-market-share-but-ios-is-tops-in-enterprise/

The company found that despite Android’s overall market share growth and steady absolute growth among Good’s customers, only 35% of all smartphone activations were on Android, compared with iPhone’s 65%.

The mid-October release of the iPhone 4S helped that particular device quickly earn the number one position on the top 10 enterprise activations list, with the iPhone 4 moving into spot #2. The iPad 2, meanwhile, claimed the third position.

Since there are far more Android devices than iPhone models, it’s not as fair to compare trends on a device-by-device basis. After all, there’s aren’t just a couple models of Android phones out there – there are dozens upon dozens of “top” (popular) devices.

However, even when looked at as a whole, Android activations accounted for just 35% of the smartphone activations and only 6% of tablet activations. The Samsung Galaxy S II was the top Android device at spot #6 and was followed by the Motorola Droid Bionic, the Motorola Droid 3, Sprint EVO 4G (Q3′s most popular Android device) and the Motorola Droid X2. Motorola phones were popular over the course of the past year, too, and were represented in the top 10 each quarter.

Good does note that iPhone activations had slowed in the previous quarter, in anticipation of the new iPhone, then jumped significantly after its launch, with 31% of smartphone activations from that device alone. But collectively, iOS devices accounted for over 70% of all activations in Q4, an indication that enterprise customers’ iOS preference wasn’t just being boosted by the iPhone 4S launch. iOS is the preferred choice in the enterprise, Good says.

On the tablet front, iOS’s domination is even more apparent – the iPad and iPad 2 account for 94% of the total tablet activations in Q4, compared with 6% for Android tablets, where the Galaxy Tab leads the pack. iPads were most popular in three industries: financial services (accounting for 42% for the quarter), business/professional services and life sciences.

Going into Q1 and Q2, Good says that it expects iPad and iPad 2 activations to slow heading into March, as customers prepare for the (rumored) launch of the iPad 3. It also expects Android activations to increase on a relative basis after the immediate impact of the iPhone 4S lessens and as BYOD (bring your own device) programs become more common.

However, says John Herrema, Senior Vice President of Corporate Strategy at Good, the company expects the iOS/Android numbers to be roughly the same during the first half of 2012 as they are now. A change would require a major shift in tablet trends. “I don’t see that happening with the iPad 3 on the horizon,” says Herrema.

“If Android and iOS split smartphone [market share] or even if Android takes the overall smartphone lead, it would still likely be no more than 40% of all Good activations overall, given the dominance of Apple on tablets and the large numbers of tablets we are activating. Meanwhile, I don’t see Android dropping substantially below where it is now because that would require major shift among BYOD smartphone users.”

We should note that this report does not look at RIM devices or Windows Phone, as Good doesn’t have insight into these platforms. This is only a comparison between the iOS/Android adoption rates in the enterprise, which by itself, limits itself to enterprise environments where BlackBerry has already fallen from favor.

Source:http://techcrunch.com/2012/01/25/android-may-have-consumer-market-share-but-ios-is-tops-in-enterprise/

No comments:

Post a Comment